Making a trip to Mexico but don’t have affordable financing options?

Look no further! Explore ADC Dental Financing in Mexico and unlock your dream smile.

Don’t let cost hold you back—discover hassle-free financing options in this article.

What Payment Plans Are Available for Dental Procedures in Mexico?

Mexico For Dental Financing

Explore various payment plans & financing strategies for dental procedures in Mexico to suit your needs:

Cash, Cheques & Credit/Debit Cards

We accept cash, cheques, and credit/debit cards.

PayPal: Buy now, Pay later!

We also accept PayPal as a payment option.

Dental Loans: SuperMoney

Finance your dental treatment with SuperMoney!

SuperMoney is integrated with renowned online leaders and offers:

- Pre-qualified offers from multiple lenders

- Multiple loan term plans

- Loans up to $100K

- Maximum safety & security with advanced encryption

- Data security – SOC 2 Type II compliance

- Complete transparency with competitive interest rates

- Free engine usage & much more!

Key Takeaways

eFinancing Solution

Your dental journey is made easier with eFinancing Solutions, a leading choice for financing medical & dental work in Mexico.

Benefit from a user-friendly application, competitive 3.99% APR rates, and exclusive 0% interest terms for qualified applicants for 6, 12, and 15 months.

eFinancing Solutions understands individual needs, offering customized financing plans for different credit levels (A, B, and C above 580).

Key Takeaways:

Get a FREE quote here or go over to eFinancing Solutions to start your dental journey today!

Dental Financing in Mexico for Canadians: Medicard® iFinance

For Canadian medical travelers, Medicard offers a straightforward and affordable financing solution.

Benefit now from:

Medicard’s patient financing programs prioritize eliminating delays in your treatment, offering various financing options with monthly payments.

Explore multiple financing options at Medicard now!

Unsecured Medical Tourism Loans

Unsecured medical tourism loans are essentially personal loans used to finance surgical procedures.

Click here for dental tourism loans for Canadians and Americans.

How Do I Qualify?

Here are the key factors that influence the likelihood of loan approval and the competitiveness of your interest rate:

Likelihood of Loan Approval

Credit Score: Lenders use the FICO scoring system, ranging from 300 to 850. Higher scores increase your approval chances.

Credit Score Range: A higher score qualifies you for higher loan amounts and lower interest rates.

Score Below 620: If your score is under 620, you may face higher interest rates, typically around 17.99% APR or more.

Competitiveness of Interest Rate

Credit Score Impact: A higher credit score generally leads to lower interest rates.

Credit Report Accuracy: Ensuring your credit report is accurate is crucial. Request the removal of late payments from old lenders, if possible.

Improve your credit score by:

Let’s see how you can benefit from financing dental work in Mexico!

What Are the Benefits of Financing Dental Work in Mexico?

When it comes to travelling for dental work to Mexico offers incredible advantages:

Embark on your journey to dental health without breaking the bank. ADC Dental Financing makes it possible.

Now, let’s see some of the risks involved in financing dental work in Mexico.

What Are the Risks of Financing Dental Work in Mexico?

While Mexico is an excellent choice, it’s vital to be aware of potential risks:

Scroll down for a comprehensive guide on financing your dental treatment in Mexico!

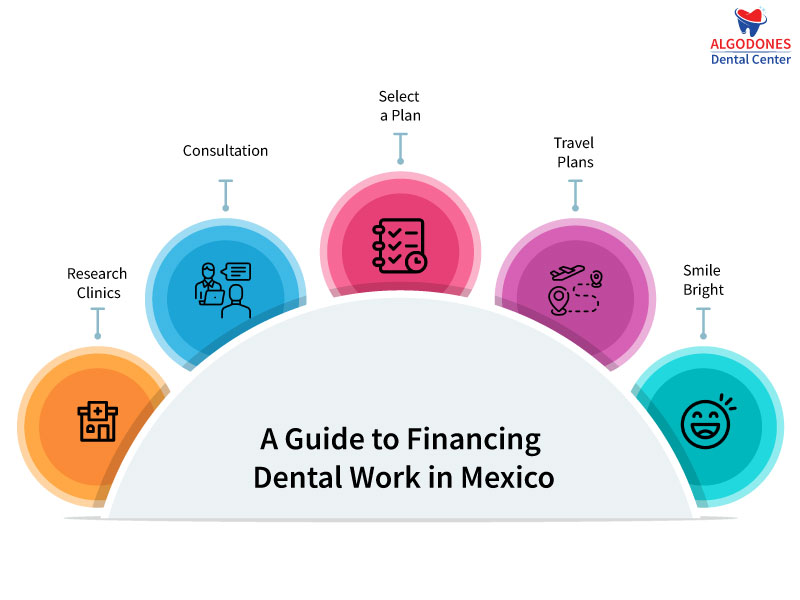

How Can I Finance Dental Work in Mexico?

Here are some helpful pointers to get you started:

A Guide to Dental Financing in Mexico

Now, let’s answer some of your frequently asked questions!

FAQs

Conclusion

Financing dental work in Mexico through ADC Dental Financing opens doors to affordable, world-class dental care.

Keep risks in check, explore flexible payment plans, and embark on your journey toward a stunning, healthy smile.

Your dream smile is now within your reach!